"Has the Reign of Cryptocurrency Tycoons Come to an End? Exploring Sam Bankman-Fried's Fall from Grace"

- Mahnoor Khakwani

- Mar 30, 2024

- 4 min read

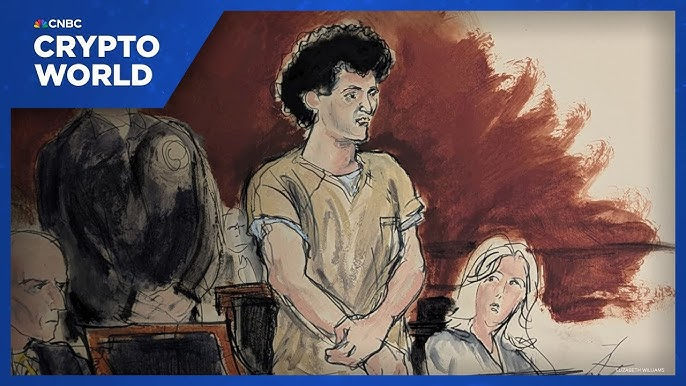

Bankman-Fried, the once-prominent billionaire in the crypto realm, who faced charges of fraud and money laundering, is scheduled for sentencing in New York on Thursday, marking another legal chapter in his downfall.

The 32-year-old's impending incarceration is inevitable, yet the duration remains uncertain. His imminent court appearance has reignited discussions regarding the severity of his offences and the appropriate retribution.

While his defence advocates for a more lenient stance, prosecutors are pushing for a hefty sentence ranging from 40 to 50 years behind bars. They argue that such severe punishment is justified given his deceitful actions towards investors and financial institutions, which resulted in the misappropriation of billions in funds from clients of his defunct cryptocurrency exchange, FTX.

The defence team is advocating for a considerably shorter sentence, proposing a term ranging from five to 6.5 years. They criticize the prosecution's insistence on prolonged imprisonment, characterizing it as an archaic approach to punishment for a non-violent, first-time offender.

The debate has sparked a deluge of letters, totalling hundreds of pages, from various individuals including former FTX customers, family members, friends of his parents, and even strangers, all attempting to sway Judge Lewis Kaplan, the federal justice presiding over the case.

Sunil Kavuri, a British investor deeply affected by the collapse of the exchange with over $2 million in holdings, questions the absence of remorse from the accused and doubts the likelihood of leniency from any judge considering such a lack of contrition. Kavuri is among those rallying former customers to share their experiences with the court to influence the sentencing decision.

The collapse of FTX in 2022 marked a dramatic downfall for Bankman-Fried, who had risen to prominence as a billionaire and business icon while promoting the platform as a convenient venue for depositing and trading cryptocurrencies.

With millions of users attracted to the platform, the emergence of rumours regarding financial instability triggered a rush among depositors to withdraw their funds.

In November 2023, a US jury determined that Bankman-Fried had illicitly siphoned off billions in customer funds from the exchange before its collapse, diverting the money towards real estate purchases, political contributions, and other investments.

Now, many of the affected customers stand on the brink of recovering substantial portions of their lost funds, thanks to a proposed plan being formulated in a separate bankruptcy proceeding.

According to this proposal, former customers could potentially reclaim funds corresponding to the value of their holdings at the time of the exchange's collapse.

In their court filings, Bankman-Fried's defence, anticipating an appeal of his conviction, has contended that the proposed recovery plan justifies a more lenient sentence. They argue that the plan's implementation demonstrates that funds remained available, suggesting that FTX's assets hadn't solely funnelled into Bankman-Fried's accounts.

However, the repayment scheme has elicited widespread outrage among former customers, as they stand to miss out on the crypto market's subsequent rebound. This aspect of the situation has intensified frustrations among those who were affected.

John Ray, the attorney overseeing FTX's bankruptcy proceedings and a vocal critic of Bankman-Fried, echoed these sentiments in a letter addressed to the court. He emphasized the ongoing suffering experienced by customers, creditors, and stockholders, both governmental and non-governmental. Ray disputed claims of minimal loss, characterizing them as indicative of Bankman-Fried's detachment from reality and his continued immersion in a "life of delusion."

Former FTX customers interviewed by the BBC expressed deep offense at the casual disregard for their hardships and implored the judge to dismiss any appeals for leniency.

Arush Sehgal, a 38-year-old tech entrepreneur residing in Barcelona, spoke candidly about his profound loss. He and his wife find themselves among the largest individual creditors of the exchange, having approximately $4 million in savings, consisting of both dollars and bitcoin, trapped within FTX at the time of its collapse.

Sehgal highlighted the stark contrast between the dismissive attitude of some and the devastating reality faced by those who have lost everything, emphasizing the urgent need for accountability and justice in their pursuit of restitution.

The perception that involvement in crypto is inherently criminal often evokes sympathy for individuals like Bankman-Fried, but many affected individuals like the one mentioned here strongly reject such associations, emphasizing their own innocence. One woman described how the collapse of FTX plunged her into depression and financial hardship, leading her to accumulate credit card debt and eventually sell a portion of her claim to an investor to alleviate her cash crunch.

Columbia Law professor Daniel Richman remarked on the unusual level of controversy surrounding the scale of Bankman-Fried's crimes in this case. However, he noted that sentencing decisions are often influenced by various factors, including the judge's impressions of the defendant and the need to deter further criminal behavior.

Judge Kaplan, known for presiding over high-profile cases involving figures like Donald Trump and Kevin Spacey, has already demonstrated skepticism towards Bankman-Fried, having revoked his bail for alleged witness intimidation.

Prof. Richman stressed the importance of defendants demonstrating remorse and a commitment to rehabilitation before sentencing, particularly in cases where obstruction of justice is evident.

Regarding sentencing guidelines for white-collar crimes, Prof. Richman noted a trend towards increased recommended jail time since the 1980s in the US. While judges often deviate from these guidelines, there remains a risk of harsh penalties, especially in high-profile cases.

In her own appeal to the judge, Bankman-Fried's mother, Barbara Fried, a former law professor, highlighted the punitive nature of the US justice system compared to other democracies, suggesting that it tends towards extreme measures.

Bankman-Fried is now confronting the grim prospect of spending up to 110 years behind bars, alongside the enduring legacy of being regarded as one of the most significant fraudsters in the annals of US history. Remarkably, lawyers involved in the bankruptcy proceedings have disclosed the recovery of over $7 billion in previously missing funds.

Mr. McKenzie, reflecting on the situation, suggests that Bankman-Fried's ascent was fueled not just by his own actions, but also by societal factors such as his prestigious lineage, educational background, and experience on Wall Street. He notes the symbiotic relationship between the mythos of Bankman-Fried and the burgeoning narrative surrounding cryptocurrency itself.

The narrative surrounding the fall of Bankman-Fried underscores broader societal considerations, prompting introspection on the interplay between individual actions and the larger cultural context within which they occur.

Comments